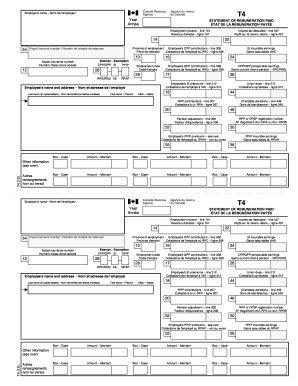

Canada SC INS3166 2012-2026 free printable template

Show details

1 2 3 Lowell Finley, SON 104414 LAW OFFICES OF LOWELL FINLEY 1604 SOLANO AVENUE BERKELEY, CALIFORNIA 94707-2109 TEL: 510-290-8823 FAX: 510-526-5424 4 Attorneys for Plaintiffs and Petitioners 5 SUPERIOR

pdfFiller is not affiliated with any government organization

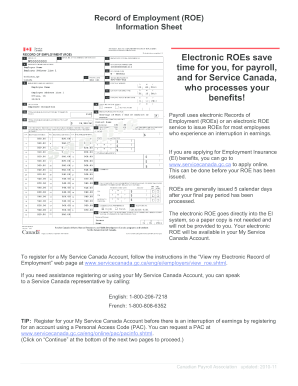

Get, Create, Make and Sign roe form cra

Edit your ins3166 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request roe forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form ins3166 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit record of employment form ins3166. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roe form download

How to fill out Canada SC INS3166

01

Obtain the Canada SC INS3166 form from the official Government of Canada website.

02

Carefully read the instructions provided with the form.

03

Fill out your personal information, including your name, date of birth, and contact details in the designated sections.

04

Provide information related to your immigration status and residency.

05

If applicable, include your employment history and supporting documents.

06

Review all entered information for accuracy.

07

Sign and date the form as required.

08

Submit the completed form along with any necessary fees or additional documents.

Who needs Canada SC INS3166?

01

Individuals applying for a Canadian temporary resident visa.

02

Anyone seeking to provide information for immigration or residency applications.

03

Persons who have been requested to submit additional information by immigration officials.

Fill

request for record of employment form ins3166

: Try Risk Free

People Also Ask about ins3166 roe fillable

How do I find my employment history for free Canada?

For more information on the ROE, go to Service Canada at Access Record of Employment on the web (ROE Web), or call their Employer Contact Centre at 1-800-367-5693 (TTY: 1-855-881-9874).

What is the difference between my account and My Service Canada Account?

These are different services from each of two Federal government agencies. CRA provides tax information. Service Canada deals with EI CPP OAS and other services.

How do I get a record of employment in Canada?

ROEs are always available online and employees can view or print copies using My Service Canada Account. Payroll service providers can now add new clients to their account online and are not required to fax a copy of the Employer Consent Form to Service Canada. ROE Web is a secure application.

How do I get a letter of employment from Service Canada?

Your confirmation of employment is available for download through MyGCPay (accessible only on the Government of Canada network).

Is My Account and My Service Canada Account the same thing?

Did you know that the Canada Revenue Agency's My Account and Employment and Social Development Canada's (ESDC) My Service Canada Account are now linked? With one user ID and password, you can securely access your information from both accounts without having to revalidate your identity!

How do I request a Roe online?

Sign up to GCKey to access ROE Web You must sign up for a GCKey before you can register to ROE Web. Select “Start with GCKey” below and follow the sign-up instructions on the Welcome to GCKey page. Once you have successfully signed up to GCKey, you will automatically be redirected to create your ROE Web account.

Do you have to pay for service in Canada?

Canada does not pay for hospital or medical services for visitors.

How do I get an access code for My Service Canada Account?

To obtain a personal access code ( PAC ), you must: provide your Social Insurance Number, first name, last name, date of birth, and your parent's family name at birth; provide your postal code if you are a Canadian resident or your country of residence if you are a foreign resident; and. have your JavaScript enabled.

Is My Service Canada Account the same as mycra?

These are different services from each of two Federal government agencies. CRA provides tax information. Service Canada deals with EI CPP OAS and other services.

How do I create a Service Canada account?

If you have an existing GCKey, you can sign in with GCKey by entering your username and password. You will then be redirected to create your My Service Canada Account. If you haven't already created a GCKey username and password, select the “Sign up” button on the Welcome to GCKey page and follow the instructions.

Can I use my CRA account for Service Canada?

If you are registered for CRA's My Account you can securely access ESDC's My Service Canada Account without having to login or revalidate your identity. The link will take you directly to your My Service Canada Account within a single secure session, without having to sign in or register with MSCA.

Why can't i access my Service Canada account?

If your MSCA is locked due to the security code, please contact our Registration and Authentication Help Desk at 1-866-279-5238.

Is my CRA account the same as my Service Canada account?

Did you know that the Canada Revenue Agency's My Account and Employment and Social Development Canada's (ESDC) My Service Canada Account are now linked? With one user ID and password, you can securely access your information from both accounts without having to revalidate your identity!

Who do I call about my Service Canada Account?

If your home address is different from your mailing address, call 1-800-206-7218 during business hours or visit a Service Canada Centre to update it.

What do I need to apply for My Service Canada Account?

You will need: your Social Insurance Number (SIN) your parent's family name at birth. your postal code if you are a Canadian resident or your country of residence if you are a foreign resident. a valid (not expired) acceptable proof of identity, such as: Canadian passport. certification of Canadian citizenship.

How do I access my service account Canada?

My Service Canada Account ( MSCA ) is a secure online portal.If you already have an access code or a provincial digital ID, choose an option to access MSCA : Sign in with GCKey. Sign in with your bank. Sign in with your province.

What is the purpose of Service Canada?

Service Canada provides Canadians with a single point of access to a wide range of government services and benefits. Sign in to your account to access the following services: Employment Insurance (EI) Canada Pension Plan (CPP)

Why I Cannot access My Service Canada Account?

Help. If your MSCA is locked due to the security code, please contact our Registration and Authentication Help Desk at 1-866-279-5238.

Can I ask for a record of employment?

You can ask your employer for a paper copy of your ROE.

Why do I need a Service Canada Account?

My Service Canada Account ( MSCA ) is a secure online portal. It allows you to view and update your information for Employment Insurance ( EI ), Canada Pension Plan ( CPP ), Canada Pension Plan disability and Old Age Security ( OAS ).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ins3166 request for record of employment to be eSigned by others?

Once your sc ins3166 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the request for record of employment ins3166 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your canada sc ins3166 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out the record of employment form on my smartphone?

Use the pdfFiller mobile app to fill out and sign request for record of employment ins3166 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is Canada SC INS3166?

Canada SC INS3166 is a tax form used by individuals or entities to report specific types of income or transactions to the Canada Revenue Agency (CRA).

Who is required to file Canada SC INS3166?

Individuals or entities that have received income or engaged in transactions that are subject to reporting requirements under Canadian tax laws are required to file Canada SC INS3166.

How to fill out Canada SC INS3166?

To fill out Canada SC INS3166, you need to provide accurate and complete information regarding your income or transactions, including identifying details, amounts, and any supporting documentation as required by the CRA.

What is the purpose of Canada SC INS3166?

The purpose of Canada SC INS3166 is to ensure compliance with tax reporting obligations and to provide the CRA with necessary information to assess taxes owed by the individual or entity.

What information must be reported on Canada SC INS3166?

The information that must be reported on Canada SC INS3166 includes personal or business identification details, types of income, amounts received, dates of transactions, and any other relevant details as specified by the form instructions.

Fill out your Canada SC INS3166 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ins3166 Forms is not the form you're looking for?Search for another form here.

Keywords relevant to ins3166 record employment

Related to ins3166 pdf print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.